__ Fee paid previously with preliminary materials.

__ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

(1) Amount previously paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

2022 Proxy Statement

Notice of Annual Meeting of Stockholders

NOTICE OF 20192022 ANNUAL MEETING OF STOCKHOLDERS

Dear Stockholders:

It is our pleasure to invite you to join our Board of Directors at our 2019the 2022 Annual Meeting of Stockholders of Greif, Inc. Due to the continued public health impact of the coronavirus (COVID-19), and to support the health and well-being of our employees and stockholders, this year's Annual Meeting will be held as a "completely virtual meeting." You will be able to attend the virtual Annual Meeting and vote your shares via a live webcast by visiting www.virtualshareholdermeeting.com/GEF2022.

DATE AND TIME:

Tuesday, February 26, 2019March 1, 2022

PLACE:

ITEMS OF BUSINESS:

1.To elect ten directors to serve for a one-year term, and

2.To transact such other business as may properly come before the meeting or any adjournments.

RECORD DATE:

Only stockholders of record of the Class B Common Stock at the close of business on December 31, 2018,2021 will be entitled to vote at the Annual Meeting.

VOTING:

We hope that Class B stockholders will promptly vote over the internet, by phone, or by mailing their proxy cards in the enclosed envelope or in person.envelope. Stockholders are always welcome to vote during the virtual meeting.

Vote by internet at www.proxyvote.com

Vote by internet at www.proxyvote.com Vote by phone at +1 800 690 6903

Vote by phone at +1 800 690 6903 Vote by mailing your proxy card

Vote by mailing your proxy card Vote in person during the virtual meeting

Vote in person during the virtual meetingOn behalf of the Board of Directors, management and employees of the Company,Greif, thank you for your continued support.

By Order of the Board of Directors,

| /s/ Gary R. Martz | ||||||||

Gary R. Martz | ||||||||

| Corporate Secretary | ||||||||

| January 14, 2022 | ||||||||

Greif - Proxy Statement 2

TABLE OF CONTENTS

| Page | ||||||

| Notice of Annual Meeting of Stockholders | 2 | |||||

| Information About the Annual Meeting | 4 | |||||

| Proposal | 5 | |||||

| Corporate Governance | ||||||

| Skills and Attributes of our Board | 10 | |||||

| Board Responsibilities | 11 | |||||

| Committees of the Board | ||||||

| Board Leadership Structure | ||||||

| Director Independence | 13 | |||||

| Board’s Role in Risk Management Oversight | ||||||

| Availability of Corporate Governance Documents | ||||||

| Director Compensation for Fiscal | ||||||

| Executive Officers of the Company | ||||||

| Stock Holdings of Certain Owners and Management | ||||||

| Compensation Discussion and Analysis | ||||||

| Summary of Executive Compensation Governance Practices | ||||||

| Compensation Committee | ||||||

| Compensation Philosophy and Objectives | ||||||

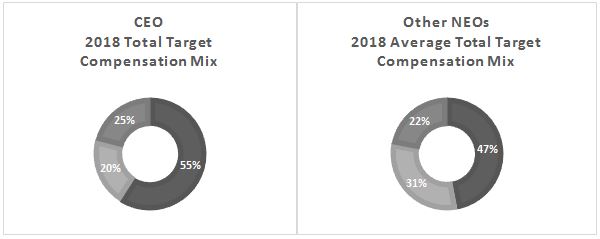

| Elements of Our Compensation Program | ||||||

| Base Salary | ||||||

| Short-Term Incentive Plan | ||||||

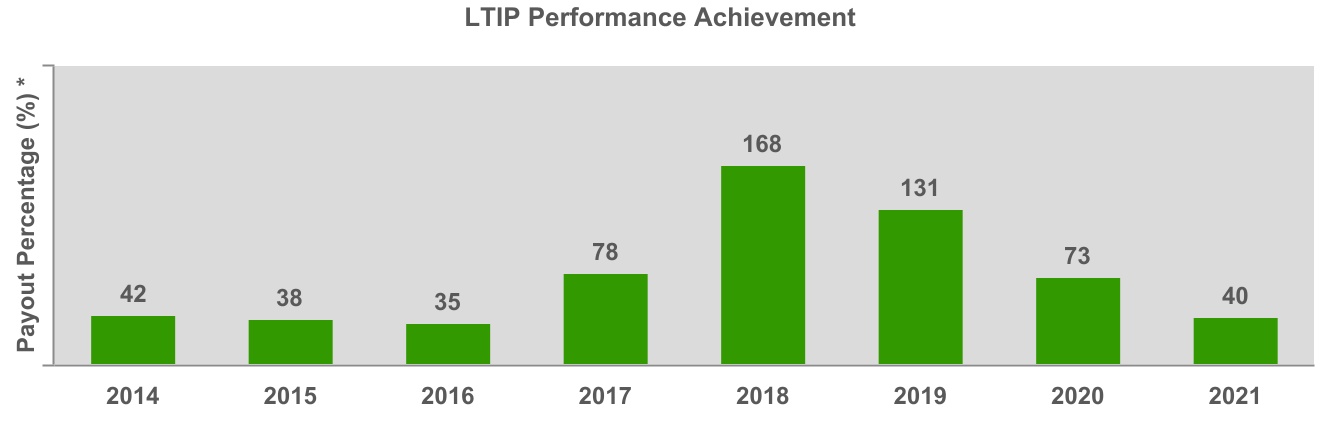

| Long-Term Incentive Plan | ||||||

| Retirement and Deferred Compensation Plans | ||||||

| "Say-on-Pay" Advisory Votes | ||||||

| 31 | ||||||

| 2021 Performance Reviews of CEO and Other NEOs | ||||||

| Compensation Committee Matters | ||||||

| Compensation Committee Report | ||||||

| Executive Compensation Tables | ||||||

| Pay Ratio | ||||||

| Audit Committee Matters | ||||||

| Report of the Audit Committee | ||||||

| Audit Committee Pre-Approval Policy | ||||||

| Fees of the Independent Registered Public Accounting Firm | ||||||

| Other Matters | ||||||

| Stockholder Nominations and Proposals | ||||||

| Certain Relationships and Related Party Transactions | ||||||

Greif - Proxy Statement 3

PROXY STATEMENT

INFORMATION ABOUT THE ANNUAL MEETING:

The 2022 Annual Meeting of Stockholders (the “Annual Meeting”) of Greif, Inc. (the “Company,” “our,” “us” and “we”) will be held on February 26, 2019,March 1, 2022, at 10:8:00 a.m., Eastern Time,Time. This year's Annual Meeting will be held as a virtual meeting via a live webcast at www.virtualshareholdermeeting.com/GEF2022. In order to attend the Company’s principal executive offices, 425 Winter Road, Delaware, Ohio 43015.Annual Meeting, you will need to access the webcast by using your 16-digit control number included on your Notice of Internet Availability or on your proxy card (if you received a printed copy of the proxy materials).

Why am I Receiving these Proxy Materials?

This proxy statement is being furnished to all stockholders of the Company in connection with the Annual Meeting.Meeting and has been made available to you electronically or by mail. It is anticipated that this proxy statement and form of proxy will first be sent to the stockholders on or about January 11, 2019.14, 2022.

Who May Vote at the Annual Meeting?

Only holders of Class B Common Stock as of the close of business on December 31, 2018,2021, are entitled to vote at the Annual Meeting and any adjournment thereof. Holders of Class A stockholdersCommon Stock are not entitled to vote at the Annual Meeting. Therefore, this proxy statement is being furnished to holders of Class A holdersCommon Stock for informational purposes only, and no proxy card is being solicited from them. On the record date of December 31, 2018,2021, there werewere 22,007,725 shares of Class B Common Stock outstanding, with each share entitled to one vote.

How do I Vote?

| VOTE IN ADVANCE OF THE MEETING | VOTE DURING THE MEETING | |||||||||||||

| Via the Internet | By Phone | By Mail | In Person | |||||||||||

| Visit www.proxyvote.com to submit a proxy via computer or your mobile device | Call 1-800-690-6903 24/7 within the United States | Mark, sign and date your proxy card and mail promptly in the enclosed postage-paid envelope. | Attend the Virtual Meeting at www.virtualshareholdermeeting.com/GEF2022 and vote by ballot. | |||||||||||

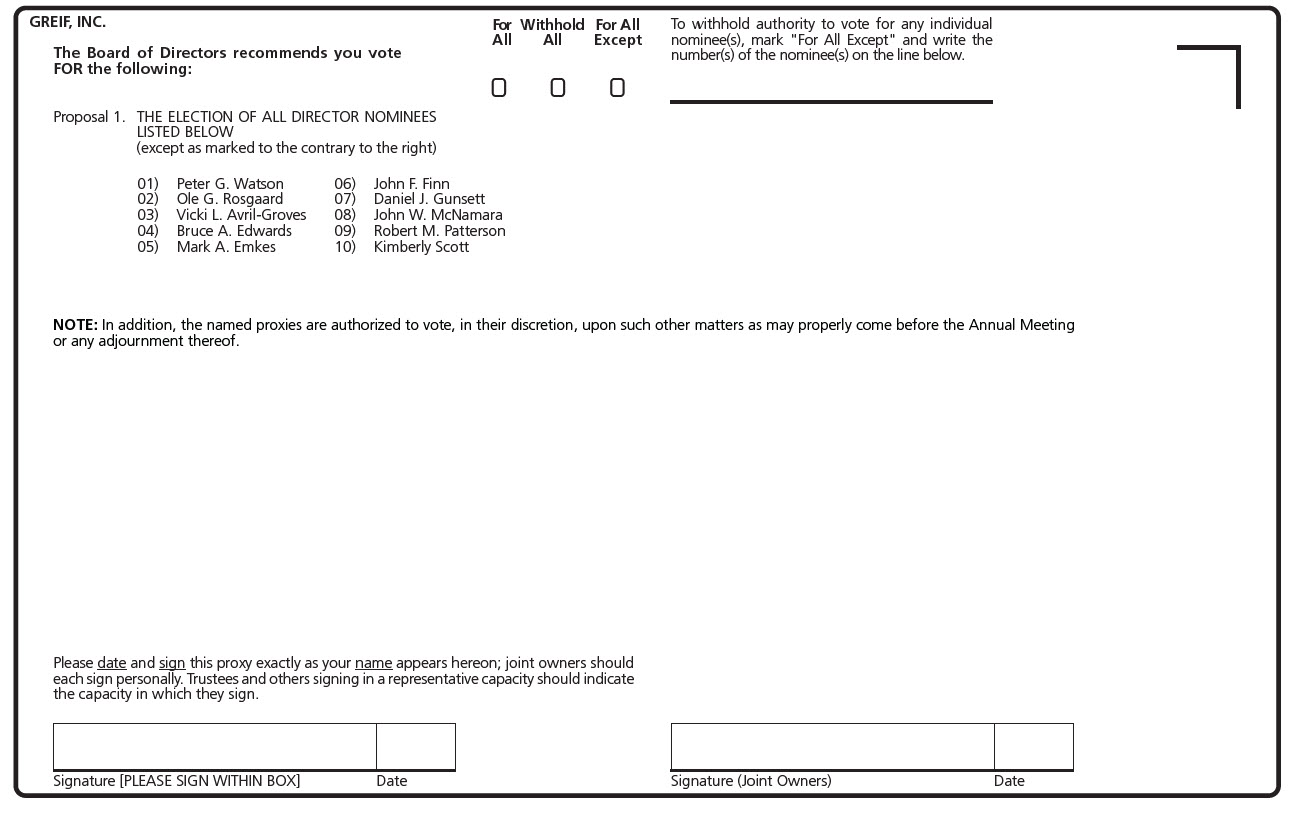

What Proposals will be Voted on at the Annual Meeting?

At the Annual Meeting, Class B stockholders will vote upon Proposal 1 - the election of nineto elect ten directors to serve for a one-year term. The Class B stockholders will also vote upon such other business as may properly come before the meeting or any adjournments.adjournment.

How are Votes Counted?

Holders of Class B Common Stock represented by properly executed proxies will be voted at the Annual Meeting in accordance with the choices indicated on the proxy. The nineten director nominees receiving the highest number of votes will be elected as directors. Class B stockholders do not have the right to cumulate their votes in the election of directors. Proxies cannot be voted at the Annual Meeting for a number of persons greater than the number of nominees named in this proxy statement. Each share of the Class B Common Stock is entitled to one vote for each director and in respect of Proposal 1. any proposal.

Abstentions will be considered as shares of Class B Common Stock present at the Annual Meeting for purposes of determining the presence of a quorum. Abstentions will not be counted in the votes cast for the election of directors and will not have a positive or negative effect on the outcome of that election.

How do I change or revoke my Vote?

Any proxy may be revoked at any time prior to its exercise by delivering to the Company a subsequently dated proxy or by giving notice of revocation to the Company in writing or in open meeting.writing. A Class B stockholder’s presence at the Annual Meeting does not by itself revoke the proxy.

Voting Instructions to Broker:

If your Class B Common Stock is held in street name, you will need to instruct your broker regarding how to vote your Class B Common Stock. Pursuant to the rules of the New York Stock Exchange, your broker does not have discretion to vote your Class B Common Stock without your instructions with respect to certain matters. If you do not provide your broker with voting instructions, your shares of Class B Common Stock will not be considered present at the Annual Meeting for purposes of determining the presence of a quorum or for voting on such matters.

This Proxy Statement, the form of proxy and the Company’s Annual Report are available at www.proxyvote.com.

Greif - Proxy Statement 4

PROPOSAL 1: Election of Directors

The Nominating and Corporate Governance Committee (the “Nominating Committee”) has recommended the nineten director nominees named below for election as directors at the Annual Meeting. All nineEight of these director nominees are presently serving on our Board of Directors (the “Board”) and eachtwo director nominees are standing for election for the first time. Each nominee has consented to being named in this proxy statement and to serve if elected for a one-year term. Patrick

Michael J. Norton who has served onGasser previously announced that he will retire from the Board forat the past 15 years,end of his current term in office and, therefore, is retiring and not standing for re-election. The sizeBoard would like to acknowledge Mr. Gasser for his over 30 years of service and his significant role in the successful growth of the Company under his leadership. Also as previously announced, Judith D. Hook, a longtime member of the Board, will be reduced from tenpassed away on November 17, 2021. The Board would like to nine directorships prior to the Annual Meeting by virtue of an amendment to the Second Amended and Restated By-Laws, as amended, that was approved by the Board. All nine of these director nominees were identified and proposed as candidatesacknowledge Ms. Hook, for her service on our Board with distinction since 2003. Ms. Hook's passion and vision for Greif, along with her leadership, counsel and friendship will be greatly missed by all.

The two new director nominees are Kimberly Scott and Ole G. Rosgaard.Ms. Scott was identified as a potential director of the Company by a search firm hired by the Nominating Committee, and after a thorough review and interview process, she has been nominated by the Board to serve as a director. Mr. Rosgaard, who will become President and Chief Executive Officer of the Company on February 1, 2022, also has been nominated by the Board to serve as a director.

The eight presently serving director nominees have been nominated to serve as directors based on their record of service and individual contributions to the overall mission and responsibilities of the Board. Unless otherwise specified, the shares of Class B Common Stock represented by the proxies at the Annual Meeting will be voted to elect the nineten director nominees named below. In the event that any of these ten director nominees isare unable to serve (which is not anticipated), the persons named as proxies in the proxy card may vote for another director nominee of their choice. TheThe names and biographies of each of the director nominees for election to the Board of Directors are set forth below.

| Director Nominees | ||

| |

| PETER G. WATSON | |||||

| Age: President and Chief Executive Officer (retiring February 1, 2022) Executive Chairman of the Board (effective February 1, 2022) Director since Mr. Watson has been named by the Board to serve as Executive Chairman of the Board of Directors effective February 1, 2022. Mr. Watson has served as President and Chief Executive Officer of the Company since November 2015. Mr. Watson Other Board Service: •Current - Ohio Health Corporation (faith and culture; compensation) •Current - Central Ohio American Heart Association | ||||

Greif - Proxy Statement 5

| OLE G. ROSGAARD | |||||

| Age: 58 Director Nominee Chief Operating Officer (until January 31, 2022) President and Chief Executive Officer (effective February 1, 2022) Mr. Rosgaard will serve as President and Chief Executive Officer of the Company effective February 1, 2022. Since July 2021, Mr. Rosgaard has served as Chief Operating Officer. From June 2019 to June 2021, he served as Senior Vice President, Group President of Mr. Rosgaard was nominated to Other Board Service: •Current - United Way of | ||||

| VICKI L. | |||||

| Age: Independent Director since 2004 Compensation Committee member From June 2008 until her retirement in September 2013, Ms. Ms. Avril-Groves was nominated to serve as a director Other Board Service: •Current - Commercial Metals Company (NYSE) (compensation (chair); nominating and corporate governance) •Current - Finning International, Inc. (TSX) (audit; safety, environmental and social responsibility) •Past - Global Brass and Copper Holdings, Inc. (NYSE) (audit; compensation; governance and nominating) | ||||

Greif - Proxy Statement 6

| BRUCE A. EDWARDS | |||||

| Age: Independent Director since 2006 Audit (Chair) Committee Audit Committee Financial Expert Lead Director (effective March 1, 2022) From March 2008 until his Mr. Edwards Other Board Service: •Current - Gustavus Adophus College (audit) •Current - ODW Logistics •Past - Deutsche Post/DHL (management board) •Past - Ashtead Group PLC (London exchange) (audit; nomination) •Past - Synergy Health PLC (London exchange) (audit; remuneration; nomination) | ||||

| MARK A. EMKES | |||||

| Age: Independent Director since 2008 Compensation Committee (Chair) member From January 2011 until his retirement in May 2013, Mr. Emkes served as Commissioner of Finance and Administration for the State of Tennessee. Previously, Mr. Emkes was Chairman and Chief Executive Officer of Bridgestone Americas, Inc. and Bridgestone Americas Holdings, Inc., a tire and rubber manufacturing company for more than five years prior to his retirement from that position in February 2010. He was also President of these companies from January 2009 until his retirement. Mr. Emkes Other Board Service: •Current - CoreCivic Corporation (NYSE) (chairman of the •Current - Boy Scouts of •Current - Community Foundation of •Past - First Horizon National Corporation (NYSE) (audit (chair); compensation; information technology) •Past - Clarcor, Inc. (formerly on the | ||||

Greif - Proxy Statement 7

| JOHN F. FINN | |||||

| Age: Independent Director since 2007 Audit and Nominating Committee member For more than five years, Mr. Finn has been Chairman and Chief Executive Officer of Gardner, Inc., a supply chain management company servicing industrial and consumer customers. Mr. Finn Other Board Service: •Current - J.P. Morgan Asset Management (registered investment company) - (chairman of the board, governance (chair); equity) •Current - Columbus Association for the Performing Arts •Past - Cardinal Health, Inc. (NYSE) (lead director, audit (chair); nominating (chair)) | ||||

| DANIEL J. GUNSETT | |||||

| Age: Independent Director since 1996 Compensation, Nominating (Chair) and Stock Repurchase Committee For more than five years and until his retirement in December 2020, Mr. Gunsett Mr. Gunsett | ||||

| Other Board Service: •Past - Recreation Unlimited Foundation |

| JOHN W. MCNAMARA | |||||

| Age: Independent Director since 2009 Audit and Nominating Committee member Prior to September 2017 and for more than five years, Mr. McNamara | ||||

Greif - Proxy Statement 8

| ROBERT M. PATTERSON | |||||

| Age: 49 Independent Director since 2020 Audit Committee member Since May 2014, Mr. Patterson has served as President and Chief Executive Officer of Avient Corporation (formerly PolyOne Corporation), a provider of specialty polymer materials, and since May 2016 has also served as its Chairman of the Board. Mr. Patterson has served in various leadership roles with Avient, including Chief Financial Officer, since joining that company in May 2008. Prior to that time, Mr. Patterson served in leadership roles at Novelis, Inc., a manufacturer of aluminum-rolled products, and SPX Corporation, a multi-industry manufacturer and developer. Mr. Patterson was nominated to serve as a director based on his leadership, experience and judgment as a current chief executive officer and chairman of a publicly traded manufacturing company and his hands on management and operations experience in various industries and markets relevant to our products and services. In making its nomination of Mr. Patterson, the Nominating Committee considered his valuable and extensive experience and knowledge in the areas of auditing, finance, global markets, operations, strategic planning, risk management, and mergers and acquisitions, and his experience as chairman of the board of a publicly traded company, which provides experience with corporate governance. Other Board Service: •Current - Avient Corporation (NYSE) (chairman of the board; environmental, health and safety) | ||||

| KIMBERLY SCOTT | |||||

| Age: 49 Director Nominee Since October 2021, Ms. Scott has served as President and Chief Executive Officer of Aramark Uniform Services, a division of Aramark, a global provider of food, facilities, and uniform services. From January 2021 to September 2021, Ms. Scott served as Chief Operating Officer of Terminix Global Holdings, a provider of residential and commercial pest control services, and from December 2019 to January 2021 she was President of Terminix Residential, a division of Terminix Global Holdings. From July 2018 to September 2019, Ms. Scott was President of Rubicon Global Holdings, a provider of cloud-based waste and recycling solutions. Prior to that time and for more than five years, Ms. Scott served in various leadership roles at Brambles Limited, including President of CHEP North America, a global leader in the provision of reusable pallets, crates and containers and logistic services. Ms. Scott was nominated to serve as a director based on her leadership, experience and judgment as a current division president and chief executive officer of a leading global food, facilities, and uniform service provider and her management and operations experience in various industries and markets relevant to our products and services. In making its nomination of Ms. Scott, the Nominating Committee considered her valuable and extensive experience and knowledge in the areas of manufacturing, supply chain, operations, logistics, strategic planning, global markets, customer service, environmental, risk management, and mergers and acquisitions. Other Board Service: •Past - Rubicon Global Holdings •Past - U.S. Chamber of Commerce •Past - Wharton Initiative for Global Environment Leadership, Wharton School, University of Pennsylvania | ||||

| Board Recommendation | ||

The Board of Directors recommends that the Class B Stockholdersstockholders vote FOR the election of all nominees listed above to the Board of Directors.

Greif - Proxy Statement 9

CORPORATE GOVERNANCE

Board of Directors

The Board currently consists of Directors is currently composed of nineeight independent directors, and one director, Mr. Watson, who asis an employee of the Company and is not independent under the New York Stock Exchange (the "NYSE"("NYSE") listing rules. Mr. NortonSee “Corporate Governance - Board of Directors - Board Leadership Structure" for additional information regarding changes to our Board and management.

| Skills and Attributes of our Board | ||||||||||||||

The Board is retiringcommitted to identifying directors for nomination with the highest ethical values and integrity, mature judgement, unbiased perspective and the sizedeep expertise necessary to provide proper oversight and counsel to the Company. The Board in collaboration with the Nominating Committee regularly evaluates the skills, qualifications and experiences desirable of our Board to successfully achieve our long-term business strategies and serve the interest of our stockholders, customers, employees and communities.

Our directors bring a balanced mix of skills, qualifications and experiences and we believe their varied backgrounds contribute to an effective and well-balanced Board. Listed below is a summary of the Board will be reduced from ten to nine directorships prior to the Annual Meeting by virtuecombined skills and attributes of an amendment to the Second Amended and Restated By-Laws, as amended, that was approved by the Board.our Board:

Leadership | Directors with senior leadership experience in complex public, private and government organizations, whether as an officer or board member, are better able to oversee the management of the Company. This experience also brings perspective in analyzing, shaping and overseeing the execution of important operational issues and developing strategy and methods to drive change and growth. Directors with leadership experience generally possess strong abilities to motivate and manage others and to recognize and develop leadership skills in others. | |||||||||||||

Governance/ Board Service | Directors with corporate governance experience gained from service on company boards provide valuable insight into the dynamics and operations of the Board and the impact that governance and compensation decisions have on the Company and stockholders. This supports the Company's goals of strong corporate governance practices through Board and management accountability, transparency, legal and regulatory compliance and protection of stockholder interests. | |||||||||||||

International | Directors with international or global markets experience bring valuable knowledge and perspective of global industry dynamics to the Company, including exposure to different cultural perspectives and practices and different political and regulatory environments. This provides critical insight into the scope of opportunities and risk related to our international operations. | |||||||||||||

Manufacturing/ Supply Chain | Directors with experience and responsibility for managing or overseeing the manufacturing operations and supply chain logistics of a company gain extensive experience with maximizing operational performance and efficiencies while managing expenses and can provide insight and guidance in connection with strategy to deliver cost savings and fuel growth through sustainable means. | |||||||||||||

Accounting/ Finance | Directors with an understanding of accounting, financial reporting, capital allocation processes and financial markets are essential to ensuring effective oversight of the Company's financial resources and processes and providing valuable advice and insights with respect to establishing a successful capital strategy critical to our ongoing success. | |||||||||||||

Strategy/ M&A | Directors with strategic planning and merger and acquisition experience are able to provide insight as we identify the best strategic manner in which to expand our business and drive growth either through innovative strategic initiatives or acquisitions and other business ventures. Such individuals can provide valuable guidance on how to develop a strategic plan and oversee the execution of key strategic initiatives and evaluating our progress of those initiatives. | |||||||||||||

Risk Management | Directors with risk management and compliance oversight experience can provide valuable insight and guide the Board and management in executing its responsibilities to identify, evaluate and understand the various risks and the magnitude of those risks facing the Company and ensure there are appropriate policies and procedures in place to effectively mitigate and manage those risks. | |||||||||||||

Government/ Legal | Directors with government and legal experience have valuable insight into the key issues the Company faces with navigating and complying with legal reporting requirements and governmental and regulatory affairs in a complex global economy. | |||||||||||||

Greif - Proxy Statement 10

| Board Responsibilities | ||||||||||||||

The Board oversees, counsels and directs management in the long-term interest of our stockholders. The primary responsibilities of the Board and committees include:

•Strategy: The Board actively works with management to develop annual and long-term strategies for the Company. The Board evaluates, approves and monitors the achievement of our business, strategic and financial objectives, plans and actions.

•Leadership and Succession Planning: The Board and the Nominating Committee are responsible for the selection and evaluation of our directors for election to the Board and oversee Board succession planning, and the Board and the Compensation Committee oversee the succession planning process for the Chief Executive Officer and other senior executive officers.

•Operating Performance: The Board regularly monitors our operational execution and financial performance, and discusses improvements and changes when appropriate. The Board holds management accountable for the execution of our strategic plans. The Board and the Audit Committee also work with management in the assessment and mitigation of our major risk factors.

•Governance: The Board and its committees oversee the establishment, implementation and maintenance of policies, practices and procedures to ensure that our business is conducted with the highest standards of ethical conduct and in conformity with applicable laws.

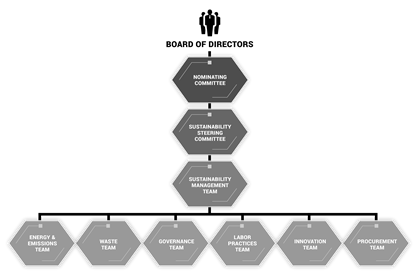

•Sustainability: The Board and the Nominating Committee monitor environmental, social and governance related issues and the Company's sustainability strategies.

| Committees of the Board | ||

The Board currently has the following committees:

| AUDIT COMMITTEE | |||||

Members: Bruce A. Edwards (Chair/Financial Expert) John F. Finn John W. McNamara Robert M. Patterson | Primary Responsibilities: •Reviews critical audit matters •Reviews and approves related party transactions | ||||

COMPENSATION COMMITTEE | |||||

Members: Vicki L. | Primary Responsibilities: •Reviews at least annually our incentive compensation and equity-based compensation plans, including their design and implementation | ||||

Greif - Proxy Statement 11

NOMINATING AND CORPORATE GOVERNANCE COMMITTEE | |||||

Members: John F. Finn Michael J. Gasser | Primary Responsibilities: •Administers and oversees the annual Board and Committee evaluation process •Reviews and recommends to the Board changes to our corporate governance guidelines | ||||

STOCK REPURCHASE COMMITTEE 0 meetings in fiscal | |||||

Members: Michael J. Gasser (Chair) Daniel J. Gunsett | Primary Responsibilities: | ||||

The Board held sixfive meetings during fiscal 20182021 and all directors attended at least 75 percent of the total number of meetings of the Board of Directors and committees on which he or she served. Under our Corporate Governance Guidelines, directors are expected to attend our Annual Meeting. All of the director nomineescurrent directors attended the 2018 Annual Meeting.

2021 virtual annual meeting.

| Board Leadership Structure | ||

Our Board is the ultimate decision-making body of the Company, except for those matters reserved to or shared with the stockholders. The day-to-day business is conducted and managed by the management of the Company under the direction of the Chief Executive Officer (“CEO”). Currently, ourOur current Board leadership structure consists of an independenta Chairman of the Board, Mr. Gasser a former CEO, seven additional independent directors and one management director, Mr. Watson, who is our former CEO (Mr. Gasser), eight additional independent directors (seven followingcurrent CEO. With the Annual Meeting) andretirement of Mr. Gasser as a director whoat the end of his current term in office, along with Mr. Watson's retirement as CEO and Mr. Rosgaard's succession to such office on February 1, 2022, the Board is implementing a new Board leadership structure. On February 1, 2022, Mr. Watson will become Executive Chairman of the current CEO (Mr. Watson).Board, and on March 1, 2022, the date of our Annual Meeting, Mr. Edwards will become the Lead Director for the Board and Mr. Rosgaard will join the Board as a management director, in each case, assuming their respective elections.

Our Board believes this new Board leadership structure is appropriatewill be a more effective structure for the Company at this time.going forward. This structure permitswill permit Mr. WatsonRosgaard to primarily focus his time and attention on the business operations, while Mr. Gasser directsWatson as Executive Chairman of the Board, will direct his attention on guiding the Board’s agenda inand setting priorities for the Company to strategically address the risksopportunities and challenges faced by the Company. Further, our Mr. Edwards, as the Lead Director, will support the Executive Chairman of the Board and act as a liaison for the independent directors. Our Board believes that itthis new structure is in the best interests of the stockholders forour stockholders. Mr. GasserWatson is uniquely qualified to serve as Executive Chairman of the Board due to his extensive knowledge of the Company based on his 17six years of experience as our CEO and as an executive officer of the former CEO. While this structure has worked particularly wellCompany for over ten years. Mr. Rosgaard, as our Board, it is notnew CEO, will have extensive insight into the Company's current opportunities and challenges. Mr. Edwards tenure as director of the Company and his service in a permanent structure. variety of roles as an independent director and business leader of other companies will add valuable insight as the Lead Director. It is the Board’s belief that no single organizational model is best or most effective in all circumstances. Therefore, although the Board has determined that this new Board leadership structure will be the current structure works bestmost effective for the Company at this time, the Board may implement another structure if deemed to be appropriate in the future.

•The majority of the Board must be independent of management and have no material relationship with the Company, either directly or indirectly as a partner, stockholder or officer of an organization that has such a relationship with the Company, and must meet the standards of independence under the applicable rules of the SEC and NYSE listing standards.

•Only independent directors are members of the Compensation, Audit and Nominating Committees.

•Independent/non-management directors meet at least four times each year, and during at least one of those meetings, the non-management directors schedule an executive session that includes only independent directors.

Greif - Proxy Statement 12

| Director Independence | ||

Pursuant to NYSE rules, in order for a director to qualify as “independent,” the Board andmust affirmatively determine that the Nominating Committee have assembled a Boarddirector has no material relationship with the Company that consists of capable and experienced directors, many of whom are currently or have been leaders of companies, who are independent thinkers and have a wide range of expertise and skills.would impair the director’s independence. The Board currently does not have a lead director. However, becausehas adopted categorical standards to assist it in making its determination of its capable and experienced independent directors, including its Chairman of the Board, and for the reasons described above, along with the above described policies that promote an open discussion among the independent directors, the Chairman of the Board and the CEO, thedirector independence.

The Board has determined that all current directors and director nominees have no material relationship with the Company and, therefore, are independent, except for Messrs. Watson and Rosgaard. Mr. Watson is currently the CEO of the Company. Mr. Rosgaard is currently the Chief Operating Officer of the Company and Mr. Watson's successor as CEO. The Board has determined that Mr. Gunsett is independent because fees for legal services rendered by Baker & Hostetler LLP, where Mr. Gunsett was a lead director ispartner during two months of fiscal 2021, were not necessary at this time.

material to the Company or to that firm during fiscal 2021 and the nature of the relationship has been properly disclosed to the Board. Mr. Gunsett retired from Baker & Hostetler LLP in December 2020.

| Board’s Role in Risk Management Oversight | ||

The Board takes an active role in the oversight of our most significant risks. The Board executes its risk oversight function at the Board level and through delegation to its Board committees. The Board does not view risk in isolation. Risks are considered in virtually every business decision and as part of our business strategy. The Board recognizes it is neither possible nor prudent to eliminate all risk. Purposeful and appropriate risk-taking is essential for us to be competitive and to achieve our long-term strategic objectives.

Our Board has been and continues to be engaged with management in the oversight of the impact of COVID-19 on the Company and the Company’s actions in response. The Board continues to identify and monitor potential risks and ensure effective oversight.

While the Board and its committees oversee risk management, management is responsible for day-to-day management of the various enterprise risks facing the Company. Management has developed and administers a formal enterprise risk management program that is a Company-wide effort involving both the Board and management. Management’s role is to identify, mitigate, guide and review the efforts of our business units with respect to risk, consider whether various risks are acceptable, and approve plans to deal with critical business risks that could prevent achievement of our business goals or plans. The Board receives detailed management reports that assess the material risk to us, including strategic, operational, financial, infrastructure, legal, regulatory and other external risks facing the Company and to be certainensure that management develops and maintains comprehensive risk management policies and procedures to assess, mitigate and monitor those risks. The risk oversight responsibilities of the Board and its committees risk oversight responsibilities are summarized below:

| Board of Directors | Audit Committee | Compensation Committee | Nominating Committee | |||||||||||||||||

Reviews related party transactions | ||||||||||||||||||||

Greif - Proxy Statement 13

The non-management directorsBoard believes that the pursuit of sustainability efforts is important to our stakeholders and should be one our strategic priorities. Sustainability efforts are pursued through an environmental, social and governance (“ESG”) framework and extend to all levels of our organization in support of our ongoing business strategy. The Board takes an active role in the oversight of ESG matters with the assistance of the Company meet withoutNominating Committee. The Nominating Committee evaluates and reviews the Company's policies, activities and programs related to ESG matters and makes recommendations to the Board. The Nominating Committee also monitors and evaluates emergent ESG related issues, risks and trends that could affect the Company's business activities and performance, and reviews and assesses the Company's progress against relevant external ESG and other sustainability indices and the Company's short-term and long-term ESG goals.

Our Sustainability Steering Committee is tasked with further integrating sustainability into our managementstrategy and operations, reviewing our sustainability progress and priorities quarterly, and ensuring accountability at least four times each year, and during at least one of those meetings, the non-management directors schedule an executive session that includes only independent directors. These meetings are typically held in conjunction with a regularly scheduled Board meeting and at such other times as necessary or appropriate. The chairpersonsall levels of our Auditorganization. Our Sustainability Steering Committee Compensation Committeemeets with the leaders of our ESG global teams that comprise the sustainability management team, who on a quarterly basis are responsible for tracking the level of achievement of our global sustainability targets. The steering committee guides the activities of our sustainability management team, which works with topic teams consisting of representatives from each of our business regions and Nominating Committee rotateunits to drive facility level projects and priorities.

Our long-term sustainability strategies include reducing our emissions to combat climate change, producing innovative products that complement our sustainability efforts, collaborating with customers to help them reduce the impact of their packaging on the environment and to assist them in meeting their decarbonization goals, and expanding our end-of-life solutions and recycling capabilities to contribute further to the growing circular economy. The Company is also actively advancing programs to create an even safer, more diverse, equitable and inclusive workforce setting where all colleagues can grow and thrive.

We published our first sustainability report in 2009 and issued our 12th consecutive sustainability report in April 2021, which was based on our fiscal year performance ending October 31, 2020. The report provides our 2025 sustainability goals and highlights progress and strategies underway to achieve those goals. Our sustainability report is prepared in accordance with the Global Reporting Initiative Standards which includes, Core Option, SASB Application Guidance and fulfills the United Nations Global Compact annual Communication on Progress. We also aligned our climate-related disclosures with recommendations from the Task Force on Climate-related Financial Disclosures. Our 2020 report is available in full at https://sustainability.greif.com/report-downloads/.

Notable sustainability highlights include the following as chairperson of meetings of the non-management directors.October 31, 2021:

Greif - Proxy Statement 14

| Social | Governance | |||||||

|  |  | ||||||

| Highlights | ||||||||

•4.5 million containers reconditioned and recycled in 2020 (86,064 metric tons virgin materials saved) •Approximately 3.4 million tons of recycled fiber collected, brokered and/or processed in 2020 •Over 90 percent of the fiber used in our paper manufacturing operations is derived from purely recycled inputs •Surpassed 2020 greenhouse gas ("GHG") emissions target (reduced emissions by 11% per unit of production from 2014 baseline) •Announced a new target to reduce absolute Scope 1 and 2 GHG emissions by 28% by 2030. This target aligns to the prevailing climate science limit of keeping global warming to well below two degrees Celsius •At least 48 facilities achieved zero waste to landfill in 2021 and diverted 85% of waste from landfills in 2021 •0.74 lost workday case rate in 2020, a 23% decrease since 2013 •Conducted an internal human rights assessment in 83 facilities within 23 countries in both 2020 and 2021 •Rated in the 90th percentile among all manufacturing companies in 2021 (Gallup Q12 Engagement Survey) •20% female representation on the Board of Directors and 23% female representation in our global workforce •Member of the World Business Council for Sustainable Development since 2008 •Signatory of United Nation Global Compact since 2016 •Member of the Alliance to End Plastic Waste in 2021 | ||||||||

| Awards | ||||||||

•Awarded a Gold recognition from EcoVadis for the third consecutive year in 2020 (top 3% of all companies assessed) •ESG rating of “A” by MSCI ESG Research LLC in 2021 •Received Prime status in 2020 by ISS ESG •Recognized by Newsweek as one of America’s Most Responsible Companies in 2021 | ||||||||

| Availability of Corporate Governance Documents | ||

Each of the Corporate Governance Documents are posted on our website at www.greif.com under “Investors-Corporate Governance-Governance Documents.” Copies of each of the Corporate Governance Documents are also available in print to any stockholder of the Company, without charge, by making a written request to the Company. Requests should be directed to Greif, Inc., Attention: Secretary, 425 Winter Road, Delaware, Ohio 43015.

Greif - Proxy Statement 15

Director Compensation for Fiscal 20182021

The following table sets forth the compensation of our directors for fiscal 2018:2021:

Name (1) | Fees ($) | Stock Awards ($) (2) | All Other Compensation ($) (3) | Total ($) | ||||||||||

Michael J. Gasser | 234,534 | 134,965 | 3,600 | 373,099 | ||||||||||

| Vicki L. Avril-Groves | 103,284 | 134,965 | — | 238,249 | ||||||||||

| Bruce A. Edwards | 116,784 | 134,965 | 1,500 | 253,249 | ||||||||||

| Mark A. Emkes | 121,284 | 134,965 | — | 256,249 | ||||||||||

| John F. Finn | 107,534 | 134,965 | 1,500 | 243,999 | ||||||||||

| Daniel J. Gunsett | 122,034 | 134,965 | 6,600 | 263,599 | ||||||||||

| Judith Hook | 105,784 | 134,965 | — | 240,749 | ||||||||||

John W. McNamara | 106,534 | 134,965 | 3,600 | 245,099 | ||||||||||

| Robert M. Patterson | 100,284 | 134,965 | — | 235,249 | ||||||||||

| Name (1) | Fees ($) | Stock Awards ($) (2) | All Other Compensation ($) | Total ($) | |

| Michael J. Gasser | 231,260 | 134,990 | — | 366,250 | |

| Vicki L. Avril | 89,010 | 134,990 | — | 224,000 | |

| Bruce A. Edwards | 102,510 | 134,990 | — | 237,500 | |

| Mark A. Emkes | 89,010 | 134,990 | — | 224,000 | |

| John F. Finn | 92,510 | 134,990 | — | 227,500 | |

Daniel J. Gunsett (3) | 109,010 | 134,990 | 3,000 | 247,000 | |

| Judith Hook | 104,010 | 134,990 | — | 239,000 | |

| John W. McNamara | 87,510 | 134,990 | — | 222,500 | |

Patrick J. Norton (4) | 89,010 | 134,990 | 10,000 | 234,000 | |

(2)Amounts in this column represent the dollar amount recognized for financial statement reporting purposes during fiscal 2021 computed in accordance with Accounting Standards Certification (“ASC”) 718 and represents the cash value of the total number of restricted shares of Class A Common Stock awarded to such director during fiscal 2021 under our 2005 Outside Directors Equity Award Plan (2,854 shares per outside director as of the 2021 annual meeting). The amounts reported reflect the closing price of our shares of Class A Common Stock on February 22, 2021 ($47.29), the day preceding the date on which the shares were granted. For a discussion of the relevant ASC 718 valuation assumptions, see Note 1 of the Notes to the Consolidated Financial Statements included in Item 8 of our Annual Report on Form 10-K for fiscal 2021 (the "2021 Form 10-K”).

As of October 31, 2018,2021, each outside director owned 9,1489,468 shares of Class A Common Stock that had been awarded to him or her under the above plan that were subject to restrictions on transfer. (Fortransfer except for Mr. Patterson who owned 2,854 shares. For the aggregate number of restricted and non-restricted shares of Class A and Class B stockCommon Stock beneficially owned by each of the outside directors, see “Security Ownership of Certain Beneficial Owners and Management.”) No stock options have been awarded to any outside directorsdirector since 2005 and no stock options remainare outstanding.

(3)All Other Compensation for Messrs. Gasser and McNamara represent the amount paid by the Company for an annual wellness physical. All Other Compensation for Messrs. Edwards and Finn represent the amount paid by the Company for strategy advisory work. All Other Compensation for Mr. Gunsett represents his receipt of $3,000 for administering the annual Board and committee evaluations during fiscal 2021 and $3,600 paid by the Company for an annual wellness physical.

| Director Compensation Arrangements | ||

The Compensation Committee is responsible for setting the overall compensation strategy and policies for our outside directors. Directors who also serve as employees for the Company or any of its subsidiaries are not compensated for their service as a director. Directors may also receive additional compensation for performing duties assigned by the Board or its committees that are considered beyond the scope of the ordinary responsibilities of a director or committee member.

In fiscal 2017,June 2021, the Compensation Committee, working with its compensation consultant, Willis Towers Watson, conducted a director compensation market survey. Based on the market survey information, the Compensation Committee approved changing the per meeting fee structure to an annual retainer fee structure, which became effective for all payments made to directors starting in July 2021. However, if the number of meetings for the Board or any individual committee exceeds eight during the fiscal year, the Compensation Committee will provide equitable compensation for the extra meetings.

Accordingly, during fiscal 2021, compensation to directors was paid under two different fee arrangements as set forth below. The annual cash retainers were paid in equal quarterly installments, as applicable, and the stock award is issued annually at the annual stockholders meeting.

| November 1, 2020 - June 30, 2021 | July 1, 2021 - October 31, 2021 | |||||||||||||

| Board of Director Fees | Board Annual Retainer | Stock Award | Board Annual Retainer | Stock Award | ||||||||||

| Chairman of the Board | $215,000 | $135,000 | $240,000 | $142,000 | ||||||||||

| All Other Outside Directors | $75,000 | $135,000 | $100,000 | $142,000 | ||||||||||

| Committee Meeting Fees | Committee Meeting Attendance | Chair Annual Retainer | Committee Annual Retainer | Chair Annual Retainer | ||||||||||

| Audit | $1,500 | $15,000 | $10,000 | $20,000 | ||||||||||

| Compensation | $1,500 | $15,000 | $10,000 | $20,000 | ||||||||||

| Nominating | $1,250 | $10,000 | $5,000 | $15,000 | ||||||||||

Greif - Proxy Statement 16

The Compensation Committee determined to increase the compensation of our outside directors beginning on January 1, 2018. The changes to our outside director compensation are as follows:

In addition to the compensation described above, we provide a health and wellness program for our outside directors which includes annual physical exams and we reimburse outside directors for expenses incurred to attend Board and committee meetings. We offer no other perquisites to our outside directors.

| Stock Ownership Guidelines for Directors | ||

Each outside director is required to own a minimum of five times his or her annual retainer in shares of Company common stock after five years of service as a director. Restricted shares of Class A Common Stock awarded to an outside director under our 2005 Outside Directors Equity Award Plan and the receipt of which has been deferred at the election of such outside director under the terms of the Directors Deferred Compensation Plan are counted as owned by the deferring outside director for purposes of these stock ownership guidelines. The Board evaluates whether exceptions should be made in the case of any outside director who, due to his or her unique financial circumstances, would incur a hardship by complying with these requirements. All current outside directors are currently in compliance with theseour stock ownership guidelines.

| Director Participation in Directors Deferred Compensation Plan | ||

The plan is considered to be an “unfunded” arrangement as amounts generally willare not be set aside or held by the Company in a trust, escrow, or similar account. Amounts deferredNotwithstanding the foregoing, deferrals of restricted stock are held in a "rabbi trust" established by the Company. Deferrals of cash compensation under the plan are credited to a participant’s account under the plan. For cash compensation deferrals, the value of the cash compensation is creditedplan as “Phantom Shares.” “Phantom Shares” have a value equal to the market value from time to time of shares of our Class A Common Stock, without par value.Stock. The number of Phantom Shares credited to a participant’s account is based on the dollar amount of deferral, divided by the then current per share value of our shares of Class A Common Stock. If a dividend is declared and credited on shares of our Class A Common Stock, without par value. Restricted stock the receiptPhantom Shares are credited with a corresponding dividend in the form of which is to be deferred is held in a so-called “rabbi” trust established by the Company.additional Phantom Shares within sixty days of that date. Dividends paid on shares of restricted stock held in the rabbi trust are contributed to the rabbi trust and are paid from the rabbi trust to the participants and are not accumulated in the rabbi trust.

•Cash compensation deferrals (credited as Phantom Shares) in a single lump sum payment, or annual installments over a five-year period or a series of five yearstwo payments. Depending on the form of payment elected, a participant may choose a fixed date for distribution or ten years or two payments on fixed dates, upon the earlier of a fixed date or such participant's termination of Board membership for any reason ormembership. If a Participant elects to receive a series of two payments, the participant must specify a fixed date for each payment and must specify the percentage of his or her cash compensation deferral to be paid on each specified date.

•Restricted stock deferrals upon termination of Board membership for any reason orupon: (a) a fixed date that is at least three years after the date of the restricted stock award,is awarded; or (b) the earlier of (i) a fixed date that is at least three years after the date of the restricted stock award and is awarded, or (ii) the participant’s termination offrom Board membership for any reason.membership.

Greif - Proxy Statement 17

Executive Officers of the Company

The following information relates to executive officers of the Company as of the date of this proxy statement (elected annually):

| Name | Age (1) | Positions and Offices | Year first became executive officer | ||||||||

| Peter G. Watson | 65 | President and Chief Executive Officer | 2011 | ||||||||

| Lawrence A. Hilsheimer | 64 | Executive Vice President, Chief Financial Officer | 2014 | ||||||||

| Ole G. Rosgaard | 59 | Chief Operating Officer | 2015 | ||||||||

| Gary R. Martz | 63 | Executive Vice President, General Counsel and Secretary | 2002 | ||||||||

| Bala V. Sathyanarayanan | 51 | Executive Vice President and Chief Human Resources Officer | 2018 | ||||||||

| Timothy L. Bergwall | 57 | Senior Vice President and Group President, Paper Packaging & Services and Soterra LLC | 2014 | ||||||||

| Michael Cronin | 64 | Senior Vice President, Enterprise Strategy and Global Sourcing, and Supply Chain | 2015 | ||||||||

| Douglas W. Lingrel | 58 | Vice President and Chief Administrative Officer | 2010 | ||||||||

| Patrick G. Mullaney | 52 | Vice President and Group President, Global Industrial Packaging | 2022 | ||||||||

| Kimberly A. Kellermann | 45 | Vice President, Global Operations Group | 2022 | ||||||||

| Tina R. Schoner | 54 | Chief Supply Chain Officer | 2022 | ||||||||

| Matthew D. Eichmann | 43 | Vice President, Investor Relations, External Relations and Sustainability | 2022 | ||||||||

| David C. Lloyd | 52 | Vice President, Controller and Treasurer | 2014 | ||||||||

| Name | Age (1) | Positions and Offices | Year first became executive officer |

| Peter G. Watson | 62 | President and Chief Executive Officer | 2011 |

| Lawrence A. Hilsheimer | 61 | Executive Vice President and Chief Financial Officer | 2014 |

| Gary R. Martz | 60 | Executive Vice President, General Counsel and Secretary | 2002 |

| Michael Cronin | 61 | Senior Vice President and Group President, RIPS EMEA and APAC, GPA and Global Key Accounts | 2015 |

| Ole G. Rosgaard | 55 | Senior Vice President and Group President, RIPS Americas and Global Sustainability | 2015 |

| Bala V. Sathyanarayanan | 48 | Senior Vice President and Chief Human Resources Officer | 2018 |

| Timothy L. Bergwall | 54 | Vice President and Group President, Paper Packaging & Services and Soterra LLC | 2014 |

| Hari K. Kumar | 56 | Vice President and Division President, Flexible Products & Services | 2016 |

| Douglas W. Lingrel | 55 | Vice President and Chief Administrative Officer | 2010 |

| David C. Lloyd | 49 | Vice President, Corporate Financial Controller and Treasurer | 2014 |

| Christopher E. Luffler | 43 | Vice President, Business Managerial Controller | 2014 |

Peter G. Watson hashas served as President and Chief Executive Officer since November 2015. From January 2014 to October 2015, Mr. Watson served as Chief Operating Officer. From September 2012 until December 2013, Mr. Watson served asPrior to that time, and for more than five years, he held various leadership roles within the Company including Vice President and Group President, Paper Packaging & Services, Global Sourcing and Supply Chain and Greif Business System. From May 2013 until May 2015,System and President of Soterra. Mr. Watson also servedwill be retiring as President of Soterra LLC, which operates our Land Management business segment. From January 2010and Chief Executive Officer on February 1, 2022 and will transition to September 2012, he served as Vice President and Division President, Paper Packaging & Services. Prior to January 2010 and for more than five years, Mr. Watson served many roles in our Paper Packaging & Services segment including President of CorrChoice (a divisionExecutive Chairman of the Company).Board effective February 1, 2022. See "Proposal 1: Election of Directors."

Lawrence A. Hilsheimer has served as Executive Vice President and Chief Financial Officer since May 2014. From April 2013 to April 2014, Mr. Hilsheimer was executive vice president and chief financial officer of The Scotts Miracle-Gro Company. From August 2012 to March 2013, Mr. Hilsheimer was the president and chief operating officer of Nationwide Retirement Plans, a division of Nationwide Mutual Insurance Company. From January 2010 to July 2012, Mr. Hilsheimer was the president and chief operating officer of Nationwide Direct & Customer Solutions, also a division of Nationwide Mutual Insurance Company. For the two years prior to that time, he was executive vice president and chief financial officer of Nationwide Mutual Insurance Company. Prior to joining Nationwide, he was vice chairman and regional managing partner for Deloitte & ToucheTouché USA, LLP, which included serving on the board of directors of the Deloitte Foundation. Mr. Hilsheimer is a director and chair of the audit committee and member of the Audit Committeenominating committee of Installed Building Products, Inc., a publicly traded (NYSE) installer of insulation products.products, and is the lead independent director and chair of the audit committee of Root, Inc., a publicly traded (Nasdaq) technology-based insurance company.

Ole G. Rosgaard has served as Chief Operating Officer since July 2021. From June 2019 to June 2021, he served as Senior Vice President, Group President of Global Industrial Packaging and from June 2019 to September 2020, Mr. Rosgaard was also responsible for Global Sustainability. From June 2017 to June 2019, Mr. Rosgaard served as Senior Vice President and Group President, Rigid Industrial Packaging & Services ("RIPS") - Americas and Global Sustainability. From August 2015 to June 2017, he served as Vice President and Division President, RIPS-North America. In January 2016, he assumed additional responsibility for RIPS-Latin America and Container Life Cycle Management LLC, a joint venture that operates our North American reconditioning business. Prior to joining the Company, and for more than five years, he served in various roles of increasing responsibility with Icopal a/s, a designer, manufacturer and installer of high end roofing solutions, including managing director in Denmark, group managing director/chief executive officer of the West European Region and group managing director/chief executive officer of the Central European Region. Mr. Rosgaard will become President and Chief Executive Officer of the Company on February 1, 2022.

Gary R. Martz has served as Executive Vice President since June 2010 (and prior to that as Senior Vice President) and as General Counsel and Secretary since joining the Company in 2002. From March 2014 until May 2014, Mr. Martz also served as Chief Administrative Officer, and from March 2018 until November 2018, served as acting Chief Human Resources Officer. Since May 2014, Mr. Martz has assumed responsibility for the management of our global real estate services department. From June 2005 until May 2013, Mr. Martz served as President of Soterra LLC. Prior to 2002,joining the Company, he was a partner in the law firm of Baker & Hostetler LLP.

Bala V. Sathyanarayananhas served as Executive Vice President and Chief Human Resource officer since July 2021. From November 2018 to June 2021, Mr. Sathyanarayanan was Senior Vice President and Chief Human Resources Officer. From January 2017 to October 2018, Mr. Sathyanarayanan served as executive vice president, human resources, North American Operations, for the Xerox Corporation. From July 2012 to January 2017, Mr. Sathyanarayanan was vice president, business transformation and human resources, Xerox Technology, a provider of print and ditigial document products and services. Prior to joining Xerox Corporation, and for

Greif - Proxy Statement 18

more than five years, Mr. Sathyanarayanan served in various human resource roles at Hewlett-Packard Inc., a global provider of personal computers and printers and printing solutions.

Timothy L. Bergwallhas served as Senior Vice President since February 2019, and as Group President of Paper Packaging & Services and President of Soterra LLC since May 2015. Prior to that and since 2014, Mr. Bergwall had served as Vice President and Division President, Paper Packaging & Services. Prior to that time and for more than five years, Mr. Bergwall served as Vice President, Containerboard Mills.

Michael Cronin has served as Senior Vice President, Enterprise Strategy, Global Sourcing and Supply Chain since September 2019. Prior to that and since May 2015, Mr. Cronin served as Senior Vice President and Group President, Rigid Industrial Packaging & Services (RIPS)-EMEA since joiningRIPS - EMEA in addition to the Company in May 2015. In January 2016,additional responsibilities he assumed additional responsibility for RIPS-APAC, Greif Packaging Accessories and Global Key Accounts.Accounts in January 2016. From February 2013 to February 2014, Mr. Cronin was chief executive officer of Coveris Packaging, a global manufacturer and distributor of packaging solutions and coated film technologies. From March 2010 to August 2012, Mr. Cronin was the president of the packaging division of SCA Hygiene Products, a Swedish consumer goods company and pulp and paper manufacturer. From January 2003 to January 2010, Mr. Cronin was the president of the European packaging division of Rio Tinto Alcan, a global mining company.

Douglas W. Lingrel has served as Vice President and Chief Administrative Officer since June 2016. From February 2009 to June 2016, Mr. Lingrel served as Chief Information Officer. From 2005 to 2009, Mr. Lingrel served as Vice President, Global Supply Chain Process and Administration.

Patrick G. Mullaney has served as Vice President and Group President, Global Industrial Packaging since November 2021. From September 2019 to October 2021, Mr. Mullaney served as Vice President, General Manager of Global Industrial Packaging - EMEA. From June 2017 to August 2019, Mr. Mullaney served as Director - Rigid Industrial Packaging & Services - EMEA Western Region and from June 2017 to September 2018, he served as Manager - Rigid Industrial Packaging & Services - EMEA Central Region. Prior to that time and for more than five years, he served in various roles at Clondalkin Group, including chief executive officer of Clondalkin Flexible Packaging, an international producer of value-added packaging products and services. Mr. Mullaney has been appointed by the Board as an executive officer effective February 1, 2022, and will serve as Senior Vice President, Group President, Global Industrial Packaging.

Kimberly A. Kellermann has served as Vice President, Global Operations since September 2019. From July 2017 to September 2019, Ms. Kellermann served as Vice President of Operations, and from September 2017 to September 2019, she held additional responsibilities in the areas of environmental, health and safety. Prior to that time and for more than five years, Ms. Kellermann served as vice president operations at West-Ward Pharmaceuticals (formerly Boehringer Ingelheim Roxane Laboratories), an international pharmaceutical company. Ms. Kellermann has been appointed by the Board as an executive officer effective February 1, 2022, and will serve as Senior Vice President, Global Operations Group.

Tina R. Schonerhas served as Chief Supply Chain Officer since joining the Company in January 2022. From November 2017 to May 2021, Ms. Schoner served as senior vice president and chief procurement officer at Oshkosh Corporation, a heavy industrial manufacturer of specialty vehicles and worksite access equipment. From January 2015 to November 2017, Ms. Schoner served as executive director of supply chain operations and strategic sourcing for Raytheon Technologies Corporation (formerly United Technologies Corporation), a global provider of high-technology products and services to building systems and aerospace industries. Ms. Schoner has been appointed by the Board as an executive officer effective February 1, 2022, and will serve as Senior Vice President, Chief Supply Chain Officer.

Matthew D. Eichmann has served as Vice President, Investor Relations, External Relations and Sustainability since September 2020. From November 2016 to September 2020, Mr. Eichmann served as Vice President, Investor Relations and Corporate Communications. From November 2015 to November 2016, Mr. Eichmann served as Vice President, Investor Relations. Prior to that time, and for more than five years, Mr. Eichmann served in various roles, including director, investor relations, at Newmont Mining Corporation, the world's leading gold company and a producer of copper, silver, zinc and lead. Mr. Eichmann has been appointed by the Board as an executive officer effective March 1, 2022, and will serve as Vice President, Chief Marketing and Sustainability Officer.

David C. Lloyd has served as Vice President, and Corporate Financial Controller since joining the Company in April 2014, and in that capacity, Mr. Lloyd is the Chief Accounting Officer of the Company. In March 2016, DavidMr. Lloyd also assumed the role of Treasurer. Prior to that time, and for more than five years, he was a partner within the accounting firm of PricewaterhouseCoopers LLP, a certified public accounting firm.LLP.

Stock Holdings of Certain Owners and Management

The following table sets forth the number of shares of each class of Greif securities beneficially owned, as of the close of business on December 31, 2018,2021, by (i) each person known to the Company to be the beneficial owner of more than 5 percent of our Class B Common Stock, our only class of voting securities, (ii) each of the nomineesdirector and nominee for director, (iii) the executive officers listed in the Summary Compensation Table (the “Named"Named Executive OfficersOfficers" or NEOs”"NEOs”), and (iv) all director nominees, NEOs,directors, NEOs, and other executive officers as a group.

| Name | Title of Class | Shares Beneficially Owned (1) | Percent of Class(2) | |||||||||||

Patricia M. Dempsey 12781 NE 72nd Boulevard, Lady Lake, FL 32162 | Class B | 3,050,502 | (3)(4) | 13.86% | ||||||||||

Shannon J. Diener 200 Civic Center Drive, Suite 1200 Columbus, OH 43215 | Class B | 3,208,886 | (3)(5) | 14.58% | ||||||||||

Mary T. McAlpin 200 Civic Center Drive, Suite 1200 Columbus, OH 43215 | Class B | 3,270,676 | (3)(6) | 14.86% | ||||||||||

Virginia D. Ragan 200 Civic Center Drive, Suite 1200 Columbus, OH 43215 | Class B | 3,578,310 | (3)(7) | 16.26% | ||||||||||

Article 4(c) Trust c/o Shannon Diener 200 Civic Center Drive, Suite 1200 Columbus, OH 43215 | Class B | 2,127,026 | (3)(8) | 9.66% | ||||||||||

Nicholas J. Petitti 200 Civic Center Drive, Suite 1200 Columbus, OH 43215 | Class B | 2,982,210 | (3)(9) | 13.55% | ||||||||||

JDH 2021 Trust c/o Nicholas J. Petitti 200 Civic Center Drive, Suite 1200 Columbus, OH 43215 | Class B | 2,317,451 | (3)(10) | 10.53% | ||||||||||

| Vicki L. Avril-Groves | Class A | 40,177 | (11) | * | ||||||||||

| Michael Cronin | Class A | 34,345 | (12) | * | ||||||||||

| Bruce A. Edwards | Class A Class B | 47,177 2,000 | (11) | * | ||||||||||

| Mark A. Emkes | Class A | 37,857 | (11) | * | ||||||||||

| John F. Finn | Class A | 35,667 | (11) | * | ||||||||||

| Michael J. Gasser | Class A Class B | 182,775 23,796 | (11) | * * | ||||||||||

| Daniel J. Gunsett | Class A Class B | 34,638 4,000 | (11) | * * | ||||||||||

| Lawrence A. Hilsheimer | Class A Class B | 83,773 87,914 | (12) | * * | ||||||||||

| Gary R. Martz | Class A Class B | 67,993 8,100 | (12) | * | ||||||||||

| John W. McNamara | Class A Class B | 30,638 440,603 | (11) (13) | * 2.00% | ||||||||||

| Robert M. Patterson | Class A | 19,760 | (11) | * | ||||||||||

| Ole G. Rosgaard | Class A | 42,956 | (12) | * | ||||||||||

| Kimberly Scott | — | — | ||||||||||||

| Peter G. Watson | Class A Class B | 228,650 4,400 | (12) | * * | ||||||||||

| All directors and executive officers as a group (22 persons) | Class A Class B | 980,718 572,033 | (11)(12) | 3.68% 2.59% | ||||||||||

(1) A person is considered to beneficially own any shares: (a) over which the person exercises sole or shared voting or investment power, or (b) of which the person has the right to acquire beneficial ownership at any time within 60 days of December 31, 2021 (such as through conversion of securities or exercise of stock options). Unless otherwise indicated, voting and investment power relating to the above shares is exercised solely by the beneficial owner (and their spouses, if applicable).

(2) * indicates less than 1 percent.

Greif - Proxy Statement 20

| Name | Title of Class | Shares Beneficially Owned (1) | Percent of Class(2) | ||

Patricia M. Dempsey 12781 NE 72nd Boulevard, Lady Lake, FL 32162 | Class B | 3,050,502 | (3)(4) | 13.86% | |

Shannon J. Diener 200 Civic Center Drive, Suite 1200 Columbus, OH 43215 | Class B | 3,219,075 | (3)(5) | 14.62% | |

Mary T. McAlpin 200 Civic Center Drive, Suite 1200 Columbus, OH 43215 | Class B | 3,208,886 | (3)(6) | 14.58% | |

Virginia D. Ragan 200 Civic Center Drive, Suite 1200 Columbus, OH 43215 | Class B | 3,567,962 | (3)(7) | 16.21% | |

Article 4(c) Trust c/o Shannon Diener 200 Civic Center Drive, Suite 1200 Columbus, OH 43215 | Class B | 2,127,026 | (3)(8) | 9.66% | |

| Vicki L. Avril | Class A | 30,709 | (9) | * | |

| Michael Cronin | Class A | 3,721 | * | ||

| Bruce A. Edwards | Class A Class B | 37,709 2,000 | (9) | * | |

| Mark A. Emkes | Class A | 27,199 | (9) | * | |

| John F. Finn | Class A | 26,199 | (9) | * | |

| Michael J. Gasser | Class A Class B | 173,307 23,796 | (9) | * * | |

| Daniel J. Gunsett | Class A Class B | 25,170 4,000 | (9) | * * | |

| Lawrence A. Hilsheimer | Class A Class B | 70,003 31,861 | * * | ||

Judith D. Hook 200 Civic Center Drive, Suite 1200 Columbus, OH 43215 | Class A Class B | 37,558 2,482,337 | (9)(10) (11) | * 11.27% | |

| Gary R. Martz | Class A Class B | 46,202 1,100 | * | ||

| John W. McNamara | Class A Class B | 21,170 436,362 | (9)(12) (13) | * 1.98% | |

| Ole G. Rosgaard | Class A | 5,415 | * | ||

| Peter G. Watson | Class A Class B | 51,299 4,400 | * * | ||

| All directors and executive officers as a group (19 persons) | Class A Class B | 589,236 2,985,856 | (9) | 2.27% 13.56% | |

(4) All shares held by Ms. Dempsey as trustee under her revocable trust and a family trust.

(5) All shares held by Ms. Diener as custodian or trustee under her revocable trust and family trusts, including the Article 4(c) Trust described in footnote (8).

(6) All shares held by Ms. McAlpin as trustee under her revocable trust and a family trust.

(7) Includes shares held by Ms. Ragan as trustee under her revocable trust and a family trust. Also includes shares held by a charitable foundation (525,140 shares) of which Ms. Ragan is the president. Does not include shares held by John W. McNamara, a director of the Company, who is Ms. Ragan’s son. Ms. Ragan disclaims beneficial ownership of the shares held by Mr. McNamara.

(8) The Article 4(c) Trust held under the Naomi C. Dempsey Declaration of Trust (the “Article 4(c) Trust”).

(9) All shares owned by Mr. Petitti individually or held by Mr. Petitti as trustee under his revocable trust and irrevocable or family trusts. Includes the shares held by Mr. Petitti as trustee of the JDH 2021 Trust described in footnote (10). Also includes 60,000 shares that have been pledged as security for a loan.

(10) The 2021 Amended and Restated Revocable (now Irrevocable) Trust created by Judith D. Hook (the "JDH 2021 Trust").

(11) This table includes restricted shares of Class A Common Stock that have been awarded to directors under our 2005 Outside Directors Equity Award Plan, including shares the receipt of which has been deferred at the director’s election under the terms of the Directors Deferred Compensation Plan. If deferral is elected, shares are issued to the trustee of a rabbi trust established in connection with the Directors Deferred Compensation Plan. The total number of shares of Class A Common Stock held in the rabbi trust for the benefit of each director as of December 31, 2021, was as follows: Ms. Avril-Groves-16,587 shares; Mr. Edwards-34,471 shares; Mr. Emkes-12,497 shares; Mr. Finn-33,667 shares; Mr. Gasser-11,227 shares; Mr. Gunsett-9,468 shares; Mr. McNamara-23,771 and Mr. Patterson-2,854 shares. See also “Corporate Governance - Director Compensation for Fiscal 2021 - Director Participation in Directors Deferred Compensation Plan.”

(12) This table does not include any restricted stock units or performance stock units that have been awarded to executive officers under our 2020 LTIP, as none of these awards have vested or will vest within 60 days of December 31, 2021. See “- Compensation Discussion and Analysis - Long-Term Incentive Plan" for further information on the 2020 LTIP and awards made thereunder.

(13) All shares (other than 3,000) held by Mr. McNamara as trustee of a family trust and a voting trust or as custodian. Does not include shares held by Virginia D. Ragan, who is Mr. McNamara’s mother. Mr. McNamara disclaims beneficial ownership of all shares of Class B Common Stock held by Ms. Ragan.

| Delinquent Section 16(a) |

Section 16(a) of the Securities Exchange Act of 1934 requires our officers and directors, and persons owning more than 10% of a registered class of our equity securities, to file reports of ownership with the Securities and Exchange Commission. Officers, directors and greater than 10% stockholders are required by the Securities and Exchange Commission’s regulations to furnish the Company with copies of all Section 16(a) forms they file. Based solely on a review of the copies of such forms furnished to the Company, the Company believes that during fiscal 20182020 all Section 16(a) filing requirements applicable to its officers, directors and greater than 10% stockholders were complied with by such persons, except as follows: (a) Ms. Raganfollows: Messrs. Bergwall and Mr. McNamaraMartz each failed to timely report one transaction involving a private sale of shares of Class B Common Stock from Ms. Ragan to a family trust of which Mr. McNamara is the sole trustee; (b) Ms. McAlpin failed to timely report one transaction involving the distribution of shares of Class B Common Stock to her from her charitable lead annuity trust; and (c) Ms. Diener failed to timely report one transaction involving a gift of shares of Class B Common Stock from her toconducted by an irrevocable family trust of which Ms. Diener is neither a trustee or beneficiary.

independent financial broker/ advisor.

Greif - Proxy Statement 21

COMPENSATION DISCUSSION AND ANALYSIS

| Overview and Introduction | ||

This Compensation Discussion and Analysis (“CD&A”) identifies and describes our compensation philosophy and objectives, summarizes our executive compensation program and discusses and reviews compensation decisions with respect to our Named Executive Officers (“NEOs”)NEOs for fiscal 2018.2021. This CD&A should be read in conjunction with the compensation related tables that immediately follow this section, as well as with our Annual Report on Form 10-K for fiscal 20182021 (“20182021 Form 10-K”). For fiscal 2018,2021, our NEOs were:

| Name | Title | ||||

| Peter G. Watson | President and Chief Executive Officer | ||||

| Lawrence A. Hilsheimer | Executive Vice President, | ||||

| Ole G. Rosgaard | Chief Operating Officer | ||||

| Gary R. Martz | Executive Vice President, General Counsel and Secretary | ||||

| Michael Cronin | Senior Vice President, | ||||

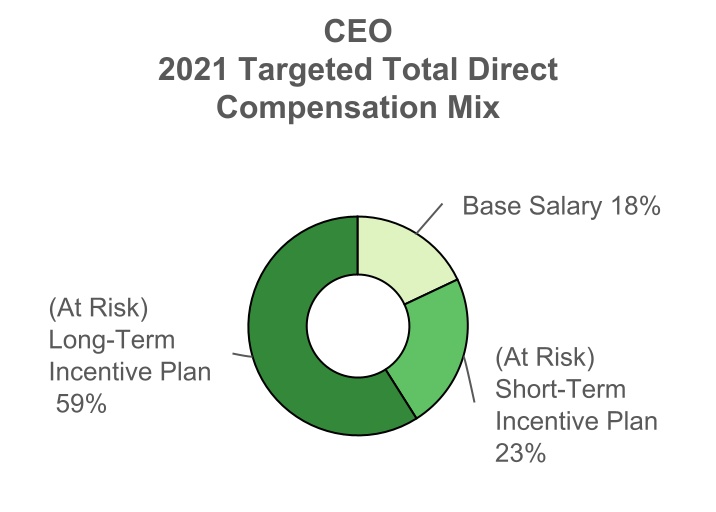

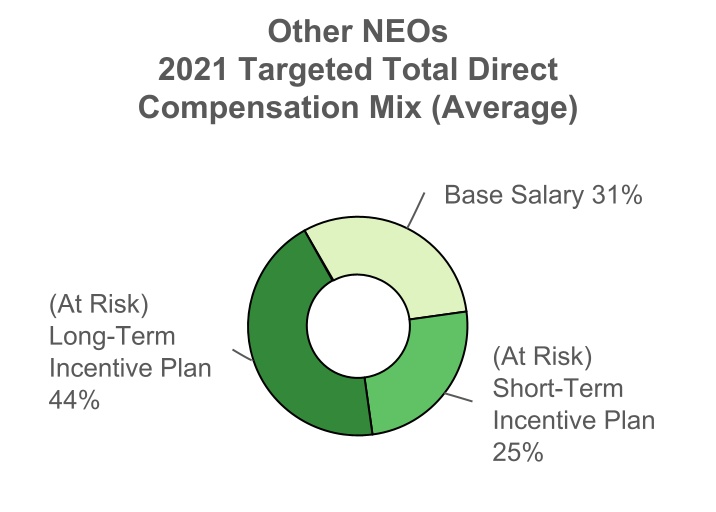

| Summary of Executive Compensation Governance Practices | ||

To achieve the objectives of our executive compensation program and emphasize our “pay-for-performance” philosophy, the Compensation Committee has continued to employ strong governance practices, including:

| We Do | We Don’t Do | ||||

ü Significant portion of executive total compensation “at risk” | û Hedging or short sales by executive officers or directors | ||||

ü Objective and different metrics for annual and long-term | û Repricing of options without stockholder approval | ||||

ü Caps on annual and long-term incentive pay | û Significant perquisites | ||||

ü Stock ownership guidelines and holding requirements | û Tax gross-ups for perquisites | ||||

ü | û Pledging of Greif stock (requires pre-approval) | ||||

ü Incentive compensation targeted at market and "pay for performance" | ûEmployment contracts or change-in-control arrangements | ||||

û Accelerated vesting of equity awards upon retirement | |||||

| Compensation Committee | ||

The Compensation Committee, whose current members are Daniel J. Gunsett-Chairperson, Vicki L. Avril, Mark A. Emkes Judith D. Hook(Chair), Vicki L. Avril-Groves and PatrickDaniel J. Norton,Gunsett, has primary oversight overfor the design and implementation of our executive compensation program. In addition, theThe Compensation Committee has a Special Subcommittee on Incentive Compensation (the “Special Subcommittee”) thatalso administers our annual cash incentive bonus plan (the “Short Term“Short-Term Incentive Plan” or “STIP”) and our long termlong-term incentive plan, which consists of our Amended and Restated Long-Term Incentive Plan initially approved by stockholders at the 2006 annual meeting, as amended (the “Long Term“2006 LTIP”), and our 2020 Long-Term Incentive Plan”Plan approved by our stockholders at the 2020 annual meeting (the "2020 LTIP," together with the 2006 LTIP, the "Long-Term Incentive Plan" or “LTIP”"LTIP"). The current members ofCompensation Committee from time to time delegates to a subcommittee certain responsibilities related to executive compensation. Prior to February 23, 2021, the Special Subcommittee are Patrick J. Norton - Chairperson, Vicki L. Avril, Mark A. EmkesCompensation Committee used a special subcommittee to administer the STIP and Judith D. Hook. All of the members of the Special Subcommittee areLTIP so that those plans were administered by “outside directors” as that term is defined in Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”).amended. Since that time the Compensation Committee has itself fulfilled all executive compensation duties. For the sake of convenience, references to the administration of the STIP and the LTIP for periods before February 23, 2021 will be to the Compensation Committee.

The Compensation Committee utilizes an independent outside compensation consultant, Willis Towers Watson, to provide it with peer group data and market information. While Willis Towers Watson also provides other services to the Company.Company, the Compensation Committee has determined that Willis Towers Watson is independent because they do not have a conflict of interest that would prevent them from providing objective advice to the Compensation Committee. In determining whether Willis Towers Watson has a conflict of interest that would influence its advice to the Compensation Committee, the Compensation Committee considered, among other things,matters, the six factors set forth in the applicable SEC regulations issued under the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, namely: the other services provided by Willis Towers Watson to the Company; the amount of fees payable by the Company to Willis Towers Watson as a percentage of that firm’s total revenues; the policies and procedures maintained by Willis Towers Watson to prevent or mitigate potential conflicts of interest; any business or personal relationship between any member of Willis Towers Watson’s executive compensation team serving the Company and any member of the Compensation Committee; any stock of the Company owned by any member of Willis Towers Watson’s executive compensation team serving the Company; and any business or personal relationship between any member of Willis Towers Watson’s executive compensation team serving the Company and any

Greif - Proxy Statement 22